Excellent Revolves Local casino Remark $10,000, 2 hundred Totally free Revolves 2024

22 June 2025Why the Most Trusted Crypto Analytics Platform Is Also Its Own Greatest Threat—and What That Means for Your Trades

22 June 2025The DexScreener Paradox: How Scam Tokens Fuel Trust in Decentralized Analytics

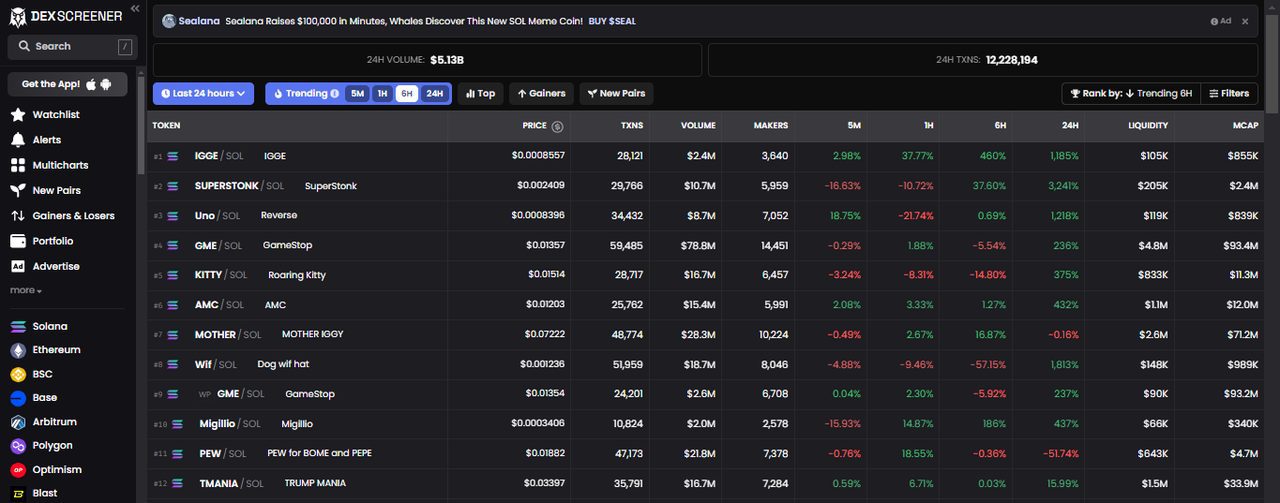

What if the very tokens that threaten to destroy a platform’s reputation are paradoxically its greatest growth engine? DexScreener, a decentralized exchange (DEX) analytics titan, thrives on a business model many would consider toxic: promoting scam tokens through paid listings. Yet, despite fierce backlash and accusations of dark patterns, it commands millions of monthly users and spectacular revenue-per-employee ratios. How can a platform simultaneously be a beacon for traders and a haven for predatory projects? The answer lies hidden in a complex dance of incentives, user psychology, and the unforgiving dynamics of DeFi’s attention economy. This article unpacks how DexScreener’s controversial model is reshaping crypto analytics—and why understanding this paradox is key for anyone serious about buying, selling, or profiting from crypto assets.

When Transparency Breeds Opacity: The Dark Side of Paid Listings

At first glance, DexScreener’s rapid ascent—boasting over 12 million monthly visits, coverage of 80+ blockchains, and over $50 million in annual revenue—is a triumph of lean, tech-first innovation. Operating with a tiny remote team of under ten employees, it wields proprietary blockchain indexing technology, bypassing third-party APIs to deliver real-time, on-chain data with blazing speed. Yet beneath this technological marvel lies a reputational fissure: the platform’s open-door policy for token listings, priced at $300 each, has flooded its ecosystem with scam and low-quality tokens.

Critics like Coinbase’s Head of Product Operations have slammed DexScreener for ‘dark patterns’ that elevate paid tokens to prominent front-page positions, effectively monetizing deception. Yet paradoxically, this very openness has created an unprecedented liquidity heatmap—an unfiltered, raw market sentiment indicator that traders flock to despite the risks. This reveals a key insight: in DeFi’s chaotic landscape, absolute transparency—even when it exposes scams—can be more valuable than curated but sanitized data.

Attention Is the New Liquidity: How Scam Tokens Drive User Engagement

DexScreener’s model exploits a behavioral economics principle rarely acknowledged in crypto analytics: the attention economy’s magnetic pull. Scam tokens, often backed by aggressive promotional packages costing over $100,000, generate hype waves that ripple across social media, Telegram trading bots, and whale-tracking alerts. This frenzy triggers FOMO, anchoring biases, and herd behavior, which ironically intensifies platform traffic and user stickiness. Traders seeking early demand signals and social sentiment cues are drawn into a volatile vortex where loss aversion battles with the lure of outsized gains.

Embedded within this ecosystem are innovative features like multi-chart correlation, automated price alerts, and portfolio stress tests that empower users to navigate the chaos. DexScreener’s integration with TradingView’s Supercharts and its REST API for developers amplify its appeal, making it a nexus where behavioral biases meet cutting-edge on-chain analytics. The platform’s freemium paradox—free core access paired with lucrative promotional services—mirrors DeFi’s own duality of openness and exploitation.

For traders hungry to harness this dynamic, DexScreener is not just a tool but a behavioral laboratory where risk maps and nudge design shape decision-making in real time.

From Data to Deception: The Regulatory and Ethical Tightrope

Despite its technical prowess, DexScreener walks a regulatory razor’s edge. The platform’s reliance on paid listings of dubious tokens invites scrutiny not only from users but also from regulators wary of implicit endorsements of fraudulent projects. Yet, no public lawsuits have emerged, suggesting a nuanced legal landscape where disclaimers and DMCA takedown procedures offer a fragile shield.

This tension spotlights a systemic paradox in DeFi analytics: platforms that prioritize speed and breadth of data access risk becoming vectors for misinformation, yet over-moderation threatens to stifle the very openness that defines decentralized finance. DexScreener’s lean corporate structure—operating as a Delaware C-Corp with a remote team—adds opacity to its governance, complicating accountability.

For savvy traders and institutional users, understanding this paradox is critical. It demands a new literacy that blends technical on-chain analytics with keen awareness of reputational and regulatory risks, moving beyond simplistic trust heuristics toward a more sophisticated risk budgeting approach.

The Behavioral Alpha of Multichain Analytics: Why DexScreener’s Edge Is Psychological

Beyond raw data, DexScreener’s true competitive moat may lie in its ability to harness behavioral KPIs embedded in its platform: whale tracking, token unlock alerts, and social sentiment overlays create a cognitive map of market psychology. This mirrors concepts from prospect theory and bounded rationality, where traders’ decisions are influenced by perceived risk and regret minimization rather than pure fundamentals.

By offering tools that surface early demand signals and liquidity heatmaps, DexScreener enables users to anticipate reflexivity loops and disposition effects—phenomena where market sentiment self-reinforces price movements. This behavioral alpha is often invisible in traditional analytics platforms constrained by centralized data feeds or limited blockchain coverage.

For traders seeking to outmaneuver volatility and impermanent loss, this insight reframes DexScreener not merely as a data aggregator but as a behavioral arbitrage platform, bridging the gap between on-chain transparency and human psychology.

Why the Future of Crypto Trading Depends on Embracing the DexScreener Paradox

In the age of information overload, DexScreener exemplifies a new paradigm where transparency and opacity coexist, where scam tokens paradoxically fuel trust and growth, and where a platform’s greatest reputational risk doubles as its most potent competitive advantage. This duality challenges conventional wisdom that equates quality strictly with curation.

For traders and token projects in the US and beyond, mastering this paradox is not optional—it is the gateway to strategic advantage. By leveraging DexScreener’s rich, unfiltered data alongside behavioral insights like loss aversion management and social proof analytics, market participants can convert noise into signal, FUD into opportunity, and uncertainty into calculated risk.

To embark on this journey and explore DexScreener’s powerful tools firsthand, go here and discover a platform that defies expectations while redefining decentralized finance analytics.

Questions That Change Everything

Is it safe to trust a platform that promotes scam tokens?

Trust in DexScreener is nuanced. The platform’s open paid listing policy means scam tokens appear alongside legitimate projects, but its real-time on-chain data and behavioral analytics tools empower vigilant traders to identify risks early. The lesson is that in DeFi, trust is less about blind belief and more about informed skepticism combined with smart risk management.

How does DexScreener’s small team handle millions of users and vast blockchain data?

DexScreener’s proprietary blockchain indexer and microservices architecture automate data parsing from 80+ networks, enabling a tiny remote team to maintain high uptime and accuracy. This exceptional automation creates a paradoxical scale-efficiency that outperforms larger competitors with bigger workforces.

Can regulatory pressure dismantle DexScreener’s business model?

While regulatory scrutiny is rising—especially regarding paid token promotions—the platform’s Delaware incorporation, disclaimers, and absence of public lawsuits suggest resiliency. However, future compliance demands may force business model adaptations, potentially shifting toward more curated or institutional-grade analytics without sacrificing its core transparency.