The DexScreener Paradox: How Scam Tokens Fuel Trust in Decentralized Analytics

22 June 2025Why The Most Trusted Crypto Analytics Platform Is Also Its Own Biggest Paradox

22 June 2025Why the Most Trusted Crypto Analytics Platform Is Also Its Own Greatest Threat—and What That Means for Your Trades

Imagine relying on a tool that simultaneously empowers your best trades and quietly fuels the very scams you fear. Sounds like a paradox? It is. The platform that millions of crypto traders swear by—offering real-time analytics across 80+ blockchains—also doubles as a magnet for predatory token promotions. Yet, this contradiction isn’t a flaw; it’s a feature born from an ingenious business model entwined with DeFi’s wild frontier. The secret to navigating this double-edged sword lies not in abandoning the platform but in understanding the subtle dance between automation, incentive design, and behavioral economics shaping your every move. This article peels back the layers of this paradox, revealing how to leverage the very architecture that threatens trust into your ultimate trading edge.

The Freemium Paradox: How Free Access Breeds a Paid-Promotion Minefield

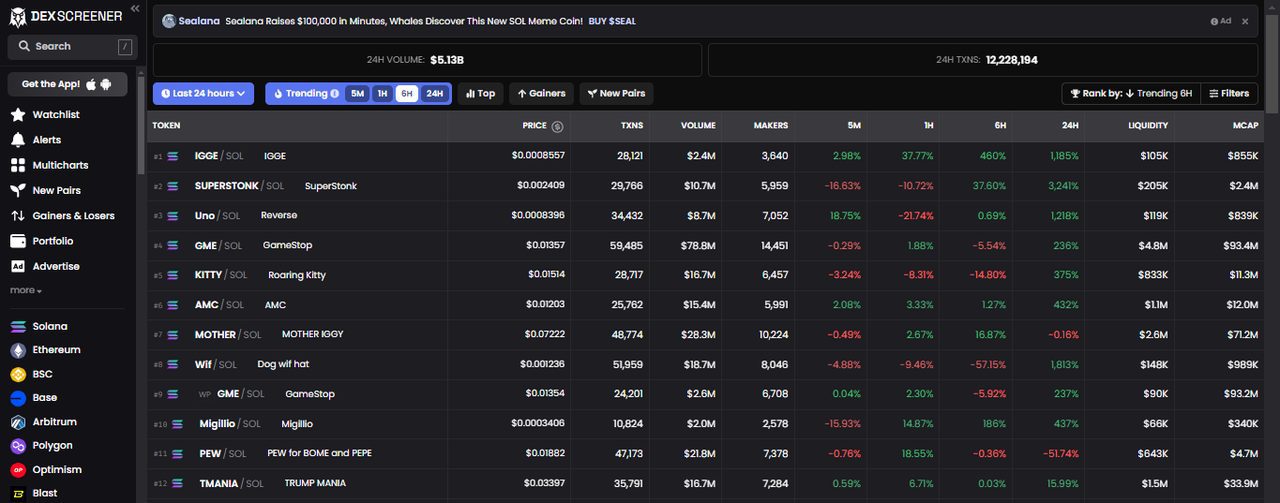

At first glance, a platform like DEX Screener appears to be the quintessential democratizer of crypto data—offering free, real-time access to charts, order books, and whale tracking for over 1.5 million monthly users. But lurking beneath this user-friendly veneer is a tension few notice. The platform’s revenue engine is powered by token listings—each costing $300—and a lucrative portfolio of promotional boosts that can exceed $100,000. This creates a “freemium paradox”: free core services build massive user trust and traffic, while paid promotions quietly prioritize visibility for tokens willing to pay, regardless of legitimacy.

This paradox forms a feedback loop: users flock to free data, token projects chase visibility through paid boosts, and the platform’s revenue balloons—reportedly between $150K and $250K daily. Yet this model also opens the door to “dark pattern” design, where scam tokens gain front-page prominence, undermining user trust and exposing traders to elevated risk. The paradox: the platform’s very success in accessibility fuels a reputational risk that could erode its user base.

Think of it like a butterfly effect in behavioral finance—small incentives at the platform level ripple outward, influencing trader psychology and market dynamics. The “attention economy” here is not neutral; it actively shapes which tokens you see and how you react, often priming you for FOMO-driven decisions that benefit paying clients more than your portfolio.

Going Beyond the Surface: Proprietary Indexing Meets Behavioral Traps

DEX Screener’s technical moat is formidable. Its proprietary blockchain indexer parses raw logs from more than 80 blockchains directly, eschewing third-party APIs to deliver data every few seconds with unmatched accuracy. This infrastructure supports sophisticated features—multi-chart correlation, whale tracking, and real-time alerts—that give traders a tactical edge in the volatile DeFi arena.

But here’s the twist: the platform’s design unintentionally exploits “bounded rationality” and “anchoring bias.” By flooding the interface with “trending” tokens—many paid promotions cloaked as organic movers—it nudges traders into cognitive overload. The sheer volume of data, combined with social proof from whale activity and “boosted” tokens, can overwhelm even seasoned investors. This “behavioral alpha” paradox means that the very tools meant to empower rational decision-making can become vectors for overtrading, regret, and loss aversion.

For instance, automated alerts and Telegram bots integrated with the platform can trigger Pavlovian responses—rapid, emotionally charged trades that favor short-term gains for token promoters over sustainable portfolio growth. The platform’s interface, while sleek, acts as a subtle “nudge ecosystem,” fostering urgency effects and status-seeking behavior that amplify risk-taking.

This is not just a technological issue—it’s a deep behavioral economics challenge embedded in the fabric of decentralized finance analytics.

From Risk to Opportunity: Mastering the “Nudge Design” in Crypto Trading

Here’s the counterintuitive insight: understanding this ecosystem’s behavioral design unlocks a new form of trader empowerment. By recognizing how the platform’s paid listing incentives and trending algorithms shape your perception, you can develop a meta-strategy that exploits these “nudges” rather than falling victim to them.

Imagine building a “risk map” that overlays liquidity heatmaps, whale tracking, and token unlock alerts with social sentiment and historical boost patterns. This transforms the platform’s apparent chaos into a “behavioral dashboard” where you identify early demand signals and FUD neutralization moments. Instead of chasing hype, you anticipate it—using the platform’s own promotional mechanics to align your entries and exits with smart-money flows.

This approach resembles “prospect theory” in action: by reframing losses as manageable and gains as calibrated, you mitigate regret and overtrading. You harness the platform’s volatility signals and slippage data not just to react but to preempt market moves. In other words, you convert the platform’s paradoxical incentives into a strategic advantage.

For traders onboarding to DEX Screener, this means customizing alerts, leveraging webhook integrations, and combining on-chain analytics with behavioral KPIs to create a frictionless UX tailored to your cognitive style. The platform’s growing API ecosystem and the Telegram bot integrations offer powerful tools to implement this approach at scale.

The Future is Multichain, but the Trust Battle Is Just Beginning

DEX Screener’s extensive coverage—over 80 blockchains and 100+ DEXs—positions it uniquely in the rapidly expanding DeFi market, projected to grow at a 40% CAGR to over $600 billion by 2033. Its integration with TradingView and mobile platforms ensures deep institutional and retail reach. Yet, as regulatory scrutiny intensifies and reputational risks from scam token promotion mount, the platform faces a critical crossroads.

Will it double down on its high-revenue, high-risk business model or pivot toward greater transparency, curated listings, and ESG initiatives? The answer will shape the broader crypto analytics landscape and determine whether traders can continue to rely on such platforms without fear of manipulation.

Meanwhile, savvy traders must embrace the paradox, mastering the behavioral and technological nuances to protect and grow their portfolios. The future of decentralized finance analytics is not just about data—it’s about decoding the psychology woven into every pixel and price chart.

For those ready to harness this paradox and elevate their trading game, the journey begins with smarter platform use. You can start exploring the cutting-edge tools and personalized features of DEX Screener here, unlocking a new dimension of crypto market insight.

Questions That Change Everything

Isn’t using a platform accused of promoting scam tokens inherently too risky?

It’s a valid concern. But risk is relative and manageable if you understand the platform’s incentive structures and behavioral design. By viewing promoted tokens as signals rather than endorsements, you gain early insights into market sentiment and potential pump cycles. The key is to combine this awareness with disciplined risk management and independent verification.

How can I avoid falling prey to behavioral traps like FOMO when using DEX Screener?

Awareness is the first defense. Customize alerts to filter noise, use multi-chart correlation to cross-validate signals, and apply mental accounting techniques to separate speculative trades from core holdings. Tools like webhook integrations and Telegram bots can automate rational decision triggers, helping override emotional impulses.

Will regulatory pressure force platforms like DEX Screener to overhaul their business models?

Increasing regulatory scrutiny is inevitable, especially around paid listings and token promotions. However, the decentralized nature of the platform and its remote operational model complicate enforcement. We may see gradual shifts toward transparency, user-driven moderation, or hybrid analytics offerings, but the balance between innovation and compliance will remain delicate.