FxPro отзывы о брокере Мошенничество и слив денег ФхПро?

10 July 2024Choosing the Best Svenk Casino Utan Licens SE for Swedish Players

19 July 2024

As with direct materials, the price and quantity variances add up to the total direct labor variance. Usually, direct labor rate variance does not occur due to change in labor rates because they are normally pretty easy to predict. A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. In this example, the Hitech company has an unfavorable labor rate variance of $90 because it has paid a higher hourly rate ($7.95) than the standard hourly rate ($7.80). Effective labor variance management is not a one-time task but an ongoing process. Companies should continuously monitor labor variances to ensure that labor costs remain aligned with budgeted expectations.

Importance of Understanding Labor Variances in Cost Management and Control

He is a four-time Dummies book author, a blogger, and a video host on accounting and finance topics. Managers can better address this situation if they have a breakdown of the variances between quantity and rate. Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement. The actual amounts paid may include extra payments for shift differentials or overtime.

How Standard Labor Rates are Created

High productivity means workers complete tasks more quickly, potentially leading to favorable efficiency variances. Conversely, low productivity can result in unfavorable variances due to more hours worked than expected. Labor efficiency variance measures the difference between the actual hours worked and the standard hours that should have been worked for the actual production level.

Case Study 2: Company B’s Approach to Managing Labor Efficiency Variance

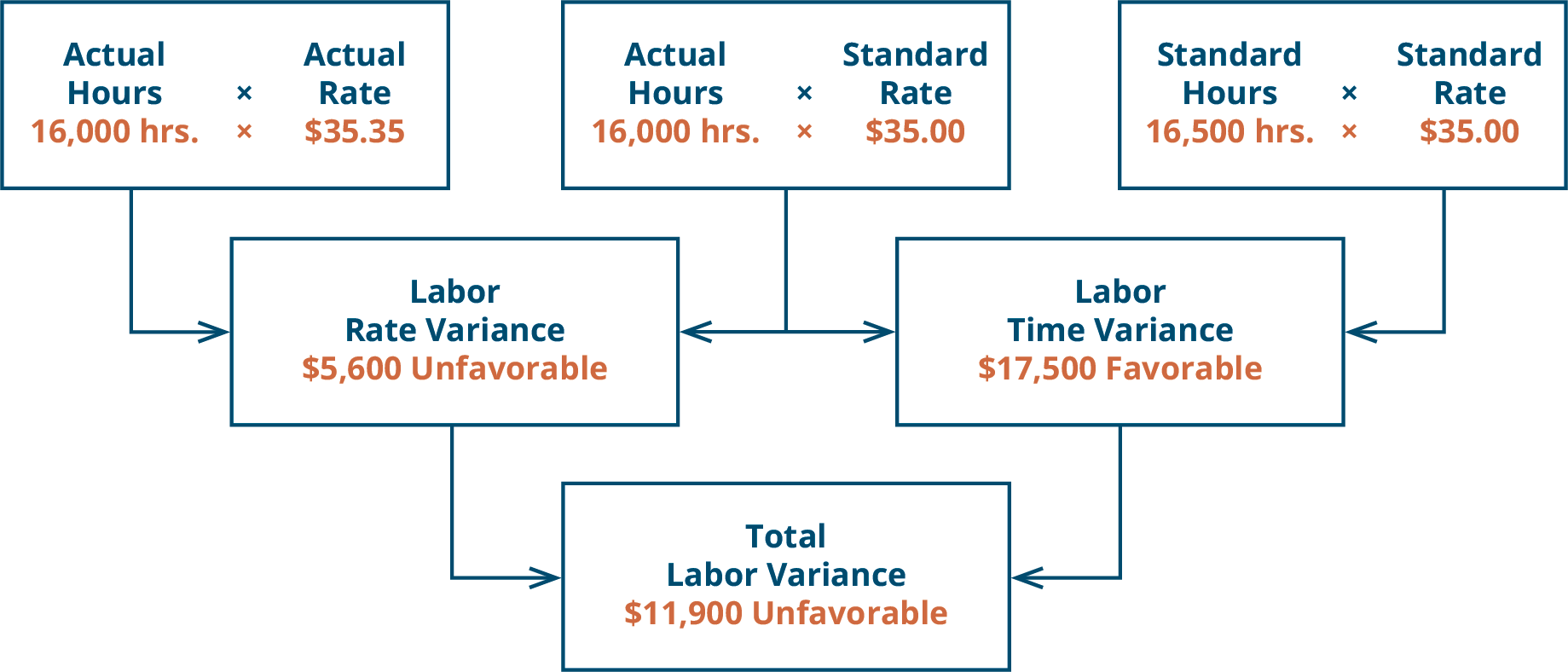

If direct materials is the cause of adverse variance, then purchase manager should bear the responsibility for his negligence in acquiring the right materials for his factory. A direct labor variance is caused by differences in either wage rates or hours worked. As with direct materials variances, you can use either formulas or a diagram to compute direct labor variances.

Direct Labor: Standard Cost, Rate Variance, Efficiency Variance

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- This results in an unfavorable labor efficiency variance of $4,000, indicating that the company used 200 more hours than expected, incurring an additional $4,000 in labor costs.

- High productivity means workers complete tasks more quickly, potentially leading to favorable efficiency variances.

- By analyzing labor rate variance, companies can determine if they are paying more or less for labor than expected and identify areas where wage cost control measures may be needed.

- By analyzing these variances, businesses can take corrective actions to align their labor expenses with budgeted costs, ultimately improving financial performance and cost control.

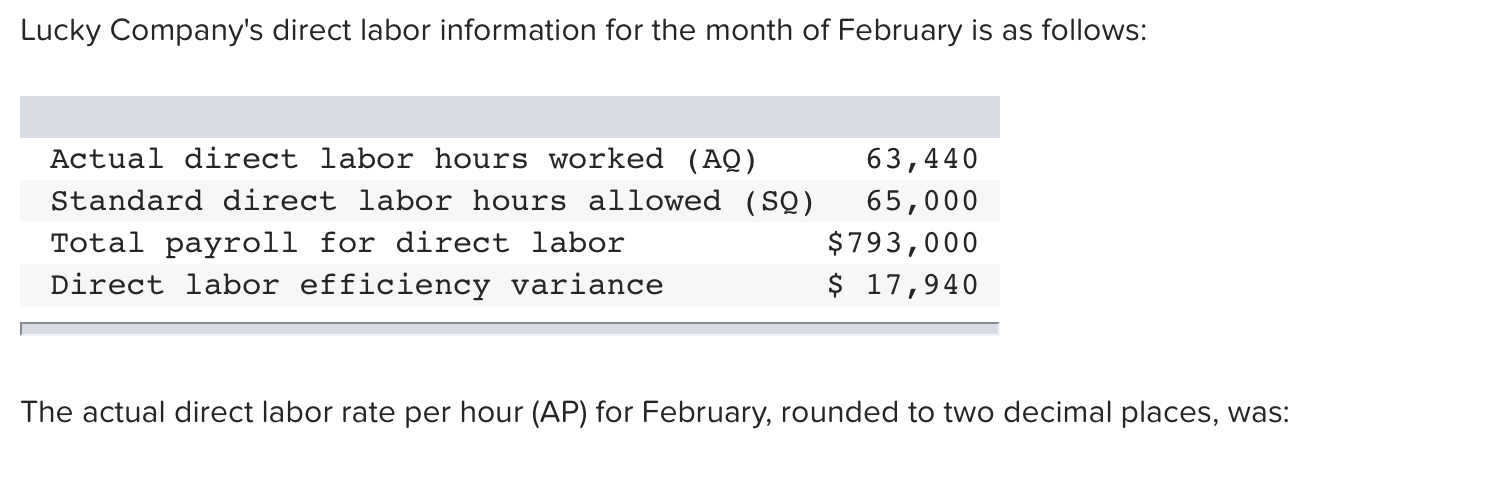

Practice Question

Lynn was surprised tolearn that direct labor and direct materials costs were so high,particularly since actual materials used and actual direct laborhours worked were below budget. We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs. This awarenesshelps managers make decisions that protect the financial health oftheir companies. The labor efficiency variance calculation presented previouslyshows that 18,900 in actual hours worked is lower than the 21,000budgeted hours. Clearly, this is favorable since theactual hours worked was lower than the expected (budgeted)hours.

These changes may cause the actual hourly rate to deviate from the standard rate, resulting in a labor rate variance. Higher-skilled workers may command higher pay rates than those budgeted for standard labor. Additionally, substituting higher-paid skilled labor for lower-paid workers can result in labor rate variances. At first glance, the responsibility of any unfavorable direct labor efficiency variance lies with the production supervisors and/or foremen because they are generally the persons in charge of using direct labor force. However, it may also occur due to substandard or low quality direct materials which require more time to handle and process.

It usually occurs when less-skilled laborers are employed (hence, cheaper wage rate). The flexible budget is comparedto actual costs, and the difference is shown in the form of twovariances. It is defined as the differencebetween the actual number of direct labor hours worked and budgeteddirect labor hours that should have been worked based on thestandards. all about irs form 1041 All tasks do not require equally skilled workers; some tasks are more complicated and require more experienced workers than others. This general fact should be kept in mind while assigning tasks to available work force. If the tasks that are not so complicated are assigned to very experienced workers, an unfavorable labor rate variance may be the result.