самые Букмекерские Конторы дли Ставок На Спорт 2024 Рейтинг Онлайн Букмекеров%2C Обзоры Б

31 July 2024Checking Out the Winning Approaches at Wolf Winner Gambling enterprise’s Online Blackjack Tables

1 August 2024

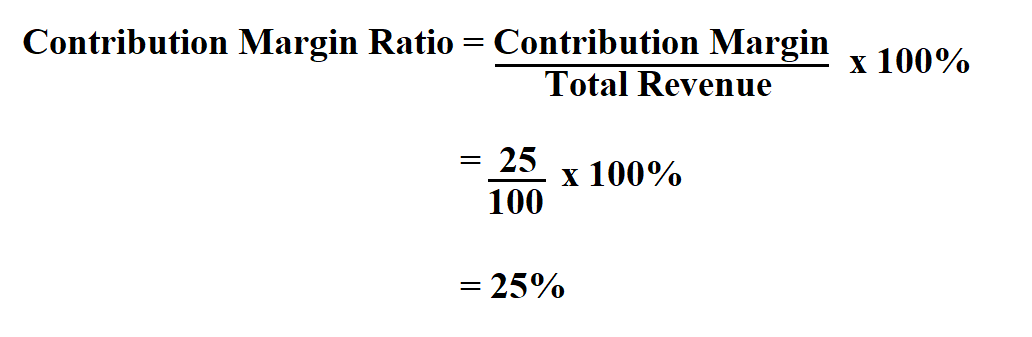

You work it out by dividing your contribution margin by the number of hours worked on any given machine. So, for example, you could calculate contribution margin ratio annually for a broad view into the impact of changes to sales, or calculate it on a single sale for a precise view into how your business is running. When preparing to calculate contribution margin ratio, you will need to add together all of your variable expenses into one number.

Operating Assumptions

The contribution margin can be presented in dollars or as a percentage. Sales (a.k.a. total sales or revenue) is the monetary value of the goods or services sold by your business during a certain reporting period (e.g., quarterly or annually). When the contribution margin is calculated on a per unit basis, it is referred to as the contribution margin per unit or unit contribution margin. You can find the contribution margin per unit using the equation shown below.

Contribution Margin Per Unit:

- Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers.

- As the name suggests, contribution margin ratio is expressed as a percentage.

- The following are the disadvantages of the contribution margin analysis.

- It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product.

- However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low.

Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. With the help of advanced artificial intelligence, Sling lets you set projected labor costs before you schedule your employees so you know what the wage ceiling will be before putting names to paper. Once those values are set, you can create the perfect schedule the first time through…without going over your labor budget. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin.

Variable Expenses

Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs. Other financial metrics related to the Contribution Margin Ratio include the gross margin ratio, operating margin ratio, and net profit margin ratio. These ratios provide insight into the overall profitability of a business from different perspectives. A firm’s ability to make profits is also revealed by the P/V ratio. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm with a low ratio. A university van will hold eight passengers, at a cost of \(\$200\) per van.

It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales.

And the quickest way to make the needed changes is to use a scheduling and labor management tool like Sling. Variable expenses are costs that change in conjunction with some other aspect of your business. Cost of materials purchased is a variable expense because it increases as sales increase or decreases as sales decrease. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins.

For example, they can simply increase the price of their products. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

Such an analysis would help you to undertake better decisions regarding where and how to sell your products. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. In 2022, the product generated $1 billion in revenue, with 20 million units sold, alongside $400 million in variable costs. Knowing how to calculate the contribution margin is an 175m mbappé tops worlds players by value; isak foden and torres stock increases invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit.

Fixed costs stay the same regardless of the number of units sold, while variable costs change per unit sold. Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales. Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. Direct Costs are the costs that can be directly identified or allocated to your products. For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods. So, you should produce those goods that generate a high contribution margin.