Oxymetholon Genopharm: Todo lo que necesitas saber sobre este esteroide

16 آوریل 2024Meilleur casino en ligne en France

25 آوریل 2024

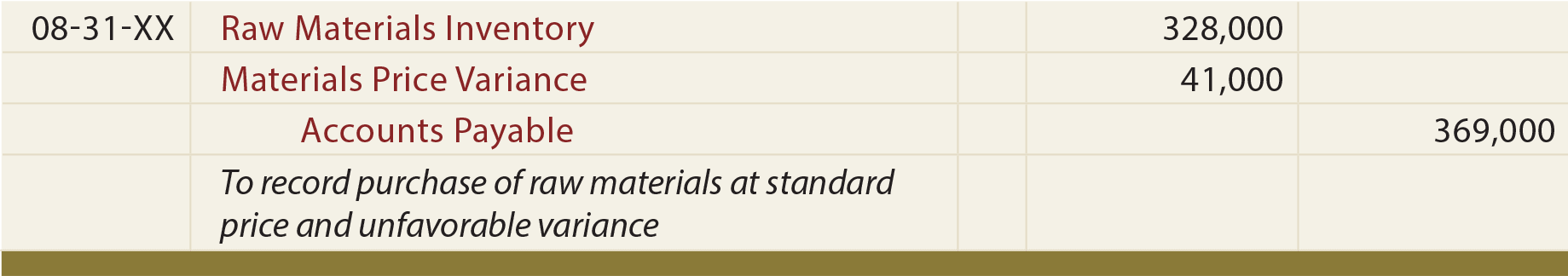

Thus sales volume variance might not be actionable enough on its own for a multi-product firm. The how to treat standard costing variances diagram used in this tutorial is available for download in PDF format by following the link below. Note that the entry shown previouslyuses standard costs, which means cost of goods sold is stated atstandard cost until the next entry is made.

( Variable manufacturing overhead variances:

So multi-product firms often break down sales volume variance into sales mix and yield variances. I cover this later in Section 7.8 because mix and yield variances are relevant to cost variances as well. This is largely what I mean when I say variance analysis compares budgeted and actual results in a “controlled and careful way.” If there are lots of possible causes for a variance, how can I decide which cause to single out for action? I have to control for other causes first, and only look at how much variance is realistically due to a particular cause.

Recording Cost of Goods Sold Transactions

A favorable direct labor price variance and an unfavorable direct labor quantity variance sound a lot the firm cut corners and hired a low-skilled workforce. An unfavorable overhead variance (e.g. driven by a need for extra human resources costs or training costs) could help confirm this diagnosis. The credit balance on the direct materials price variance account (400) splits between the raw materials inventory account (160) and the cost of goods sold account (240).

Variable Overhead Rate Variance

Because Direct Materials Inventory reports the standard cost of the actual materials on hand, we reduce the account balance by $870 (the 290 yards actually used x the standard cost of $3 per yard). After removing 290 yards of materials, the balance in the Direct Materials Inventory account as of January 31 is $2,130 (710 yards x the standard cost of $3 per yard). Since variable overhead is consumed at the presumed rate of $10 per hour, this means that $125,000 of variable overhead (actual hours X standard rate) was attributable to the output achieved. Comparing this figure ($125,000) to the standard cost ($102,000) reveals an unfavorable variable overhead efficiency variance of $23,000. However, this inefficiency was significantly offset by the $20,000 favorable variable overhead spending variance ($105,000 vs. $125,000).

2.4 Quick Note on Multi-product Firms’ Sales Volume Variance

These two equations use the term PDFOH rate, which means the “predetermined fixed overhead rate.” This term expresses the portion of the PDOH rate that applies fixed overhead costs to units. Let’s say the standard quantity is actually 6 ounces, that is, given the number of finished goods units produced, the budget would predict that the company use six ounces. Debit to WIP is $480 (standard price of $80 times standard quantity used of 6). An unfavorable price variance suggests a problem within the purchasing department of the firm or a change in the external market for this input. It could also be related to the firm’s differentiation strategy and purchasing high-quality direct materials.

Standard Costing and Variance Analysis

The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse. A manufacturer must disclose in its financial statements the amount of finished goods, work-in-process, and raw materials. Accounting professionals have a materiality accrual accounting guideline which allows a company to make an exception to an accounting principle if the amount in question is insignificant. Later in Part 6 we will discuss what to do with the balances in the direct labor variance accounts under the heading What To Do With Variance Amounts. In February DenimWorks manufactured 200 large aprons and 100 small aprons.

How much direct material is used is determined when direct materials are added to work in process. The responsible party in this case is the factory manager or factory workers in general. By using two different actual quantities, direct materials variances better assign responsibility. So some of the difference between budgeted and actual cost numbers is because the firm actually produced a different number of units than budgeted.

- Another example is the cost of the manufacturing supplies (such as needles and thread) that increase when production increases.

- Furthermore, variances help inform the firm’s budgeted numbers this period, including actions the firm takes to improve actual profit next period.

- Variance analysis should also be performed to evaluate spending and utilization for factory overhead.

- An unfavorable price variance suggests a problem within the purchasing department of the firm or a change in the external market for this input.

- Allowing for normal inefficiencies, the product is expected to require 0.50 hours of labor at a cost of 15.00 per labor hour.

Standard costs are compared to actual costs, and mathematical deviations between the two are termed variances. Favorable variances result when actual costs are less than standard costs, and vice versa. The following illustration is intended to demonstrate the very basic relationship between actual cost and standard cost. SQ and SP refer to the “standard” quantity and price that was anticipated.

Labor rate often become unfavorable when too few workers are employed (meaning overtime pay), more highly skilled worker time was required than budgeted, and benefits are higher than budgeted. Also notice that, for the above revenue calculations, quantity was expressed as a total figure and price was expressed per unit. Sales volume variance is actionable because it reflects the overall volume of sales.