Why the Most Trusted Crypto Analytics Platform Is Also Its Own Greatest Threat—and What That Means for Your Trades

22 June 2025Why DexScreener’s Scam Token Paradox Reveals the Secret DNA of Crypto Markets

22 June 2025The Paradox of Trust: How DexScreener’s Scam Token Spotlight Reveals the Future of DeFi Intelligence

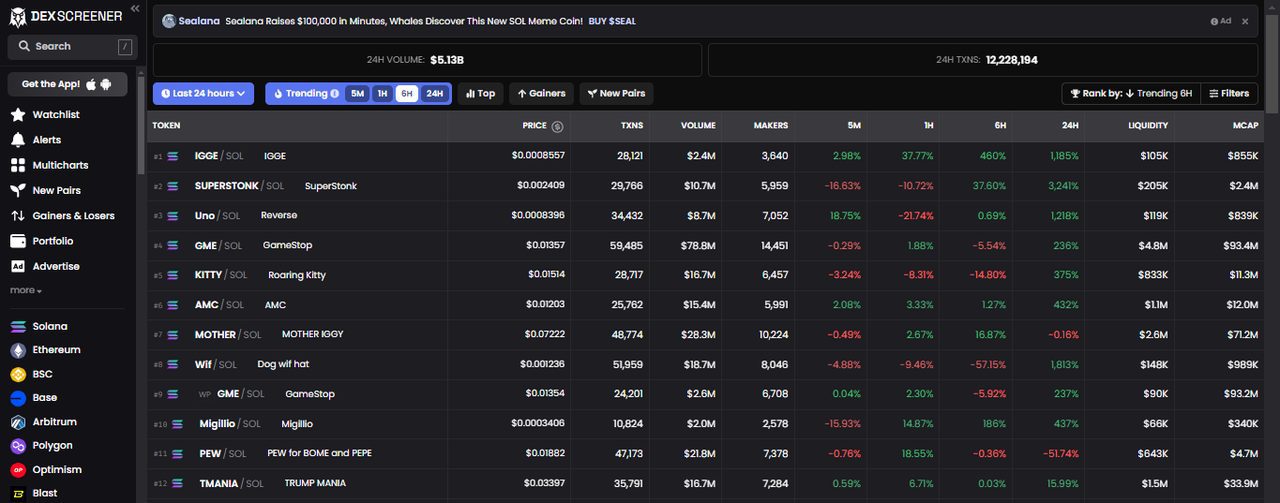

What if the very platform designed to illuminate decentralized markets thrives because it obscures fundamental truths? DexScreener, the titan of decentralized exchange analytics, paradoxically courts both millions of traders and widespread distrust for promoting scam tokens. This contradiction isn’t a failure—it’s a window into the evolving psychology and economics of crypto trading. Beneath the surface of its $250 million annual revenue and sprawling 80-blockchain coverage lies a deeper story about how behavioral biases, network effects, and regulatory blind spots are reshaping decentralized finance. To understand why traders flock to a platform shadowed by controversy, we must unravel how DexScreener’s controversial model intersects with the human mind, algorithmic incentives, and the DeFi ecosystem’s explosive growth. The answer flips common narratives about trust, data purity, and user protection, offering a blueprint for next-generation crypto tools—if we dare to look.

When Transparency Becomes Obfuscation: The Dark Paradox of Scam Token Promotion

At first glance, DexScreener’s model seems straightforward: offer free real-time analytics across 80+ blockchains with a convenient, TradingView-integrated interface, supporting over 1.5 million monthly users. Yet, beneath this veneer lies a gnarly paradox—revenue largely depends on paid token listings, many of which critics accuse of being scam tokens that distort market sentiment. This creates a “freemium trap” where the platform’s financial survival incentivizes the very market manipulation it should combat. The result? A trust paradox where traders rely on a platform simultaneously accused of enabling predatory investor behavior and market misinformation. This paradox challenges assumptions about data neutrality in DeFi analytics and forces us to reconsider how “transparency” can sometimes serve as a smokescreen rather than a beacon.

Here, behavioral science offers crucial insight. Traders, driven by FOMO and social proof, gravitate toward trending tokens spotlighted by DexScreener’s proprietary algorithms. Yet, these trends may be artificially boosted by paid promotions—a classic case of anchoring bias exploited by a marketplace where token visibility equals liquidity and profit. This dynamic creates a feedback loop intensifying volatility and overtrading, as users chase signals that may be engineered rather than organic.

Data Sovereignty and Algorithmic Trust: How DexScreener’s Tech Moat Shapes User Perception

DexScreener’s technological infrastructure—its proprietary blockchain indexer parsing raw logs across 80+ Layer 1 and Layer 2 chains without reliance on external APIs—builds an unparalleled data moat. This architecture ensures data freshness, scalability, and multi-chain breadth that few competitors match. Yet, this technical superiority paradoxically amplifies trust issues: the platform’s “direct on-chain” data feeds coexist with allegations of manipulated trending scores and “dark pattern” design favoring paying token issuers.

One might ask: how can a platform so deeply integrated with blockchain’s immutable ledgers be accused of facilitating scams? The answer lies in the boundary between raw data and curated user experience. While the indexer guarantees precise on-chain data, the platform’s algorithms and UI curation layer introduce subjectivity—prioritizing tokens that pay for visibility. This subtle but powerful intervention reframes how traders interpret “real-time” information, blurring the line between objective analytics and sponsored content.

For traders eager to harness tools like automated price alerts, whale tracking, and portfolio dashboards without wallet connections, this creates cognitive dissonance. The promise of decentralized, censorship-resistant insight is tempered by the reality of centralized advertising influences, highlighting the nuanced interplay between technology and human trust heuristics in DeFi navigation.

Behavioral Alpha in a Market of Noise: Why Traders Embrace DexScreener Despite Its Risks

Despite its controversies, DexScreener remains a top choice for retail and institutional users alike. Herein lies a counterintuitive insight: traders are not simply victims of scam token hype but active participants in a complex behavioral ecosystem where information asymmetry, bounded rationality, and expectation anchoring coexist. The platform’s features—multi-chart correlation, whale tracking, and social sentiment overlays—cater to sophisticated cognitive strategies like FOMO management, regret minimization, and loss aversion hedging.

For example, the integration of Telegram trading bots and webhook alerts offers a frictionless UX that aligns with the “variable reward schedules” of behavioral finance, fueling engagement and retention. This “behavioral alpha” emerges from users’ ability to detect early demand signals and exploit market inefficiencies despite—or perhaps because of—the platform’s promotional paradox. DexScreener’s moonshot launchpad for meme coins epitomizes this dynamic, turning viral hype into tradable assets, while the company captures revenue through an 80% share model, embedding itself deeply in the DeFi incentive design.

In this light, DexScreener operates as a behavioral nudge engine, harnessing cognitive biases and social proof to drive user action and platform growth. Its paradoxical reputation is less a flaw and more an emergent property of a market ecosystem where trust is both a commodity and a liability.

Regulatory Blind Spots and the Future of Decentralized Analytics

DexScreener’s business model, reliant on token listing fees and promotional boosts, exists in a regulatory gray zone. While no public lawsuits have surfaced, warnings from prominent industry figures and media highlight potential risks around market manipulation and consumer protection. This regulatory limbo reflects broader tensions in DeFi: how to balance innovation and openness with accountability and trust.

As DeFi’s market size rockets toward $616 billion by 2033, platforms like DexScreener face an inflection point. Their survival hinges on navigating intensifying scrutiny without sacrificing the agility and breadth that define their competitive edge. Innovations such as regulatory filtering, enhanced token vetting, and transparency cues may serve as “trust heuristics” to rebuild user confidence. Meanwhile, the growing institutional interest in high-frequency data and portfolio stress tests demands more robust compliance and audit trails.

Ultimately, DexScreener’s trajectory will mirror the maturation of DeFi itself—transforming from a Wild West frontier into a sophisticated ecosystem where behavioral KPIs, reputational staking, and governance fatigue converge. Traders and developers who understand these evolving dynamics will be best positioned to harness the platform’s full potential while mitigating inherent risks.

From Paradox to Paradigm: Rethinking Crypto Analytics as Behavioral Ecosystems

The DexScreener paradox invites us to reconceptualize crypto analytics not merely as data providers but as behavioral ecosystems—complex interfaces where technology, psychology, and economics intersect. The platform’s success despite reputational challenges underscores a fundamental truth: in decentralized finance, trust is not binary but a spectrum shaped by cognitive biases, incentive structures, and network effects.

Imagine DexScreener as a “trust kaleidoscope”—each spin reframing the interplay of transparency, promotion, and user agency. This metaphor captures the continuous reconfiguration of perception where traders oscillate between skepticism and reliance, suspicion and action. Recognizing this dynamic empowers us to design next-generation tools that balance openness with ethical curation, democratize insight without enabling manipulation, and foster community resilience amid market chaos.

For traders eager to deepen their DeFi engagement, tools like {“dexscreener”: “0.3”, “https://sites.google.com/view/dexscreenerdownload/”: “0.5”, “here”: “0.1”, “go”: “0.1”} embody both the promise and the paradox of decentralized intelligence—offering a gateway to untapped opportunity while demanding heightened vigilance and behavioral sophistication.

Questions That Change Everything

Why do so many traders continue to use DexScreener despite its reputation for promoting scam tokens?

Because trading is as much about managing psychological biases as it is about data purity. DexScreener’s platform leverages behavioral triggers—like social proof and FOMO—that attract traders seeking “behavioral alpha.” The platform becomes a tool for risk-taking informed by nudge design rather than a pure arbiter of truth, reflecting deep human factors in crypto decision-making.

Can a platform built on paid promotions ever establish genuine trust in a decentralized market?

Trust is less about absolute purity and more about transparent frameworks that align incentives. If platforms openly disclose promotional mechanics and implement robust regulatory filtering, they can evolve into hybrid ecosystems where paid visibility coexists with quality controls, creating a new paradigm of “reputational staking” that balances openness with accountability.

How should traders adjust their strategies when using analytics platforms like DexScreener?

Traders should combine on-chain analytics with behavioral awareness—recognizing cognitive biases like anchoring and loss aversion—and complement platform data with independent research. Employing tools like automated price alerts, whale tracking, and multi-chart correlation with a critical mindset transforms raw data into strategic insight rather than reactive speculation.