Remote Kotlin Developer Jobs

17 November 20217% na Otwartym Koncie Oszczędnościowym Bonus w ING Banku Śląskim Bankonauci

11 January 2022

This treatment ensures that the financial statements accurately reflect the company’s operational costs and help in assessing its profitability during a specific accounting period. Period costs don’t directly appear on the balance sheet; however, their implications are significant. Unpaid period costs may lead to increased liabilities under accounts payable. For instance, if you’ve incurred marketing expenses but haven’t paid them yet, your current liabilities increase accordingly. Additionally, consistent tracking of fixed and variable period costs supports accurate budgeting for future periods, enhancing cash flow forecasts and resource allocation strategies.

- Further, it is also stated that these occur during Indian premier league matches every year, and hence they are incurred periodically.

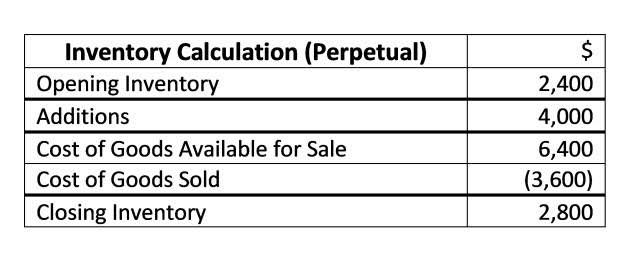

- Weighted-average costing combines current-period expenses with prior-period costs in the beginning inventory.

- They form part of inventory and are charged against revenue, i.e. cost of sales, only when sold.

- Controlling overhead and fixed expenses is essential for businesses to improve profitability.

- To overcome these challenges, finance professionals should employ robust cost accounting systems, utilize appropriate cost allocation methods, and consider qualitative factors in their analyses.

Part of inventory costs

However, for management objectives, managers frequently require the assignment of nonmanufacturing costs to goods. This is especially true for specific product-related commissions and promotions. Fixed costs are considered time costs and are included in the Profit and Loss Account.

Pre-Determined Expenses

Indirect costs or indirect expenses, are costs which cannot be Certified Public Accountant traced directly to a particular cost object. In schools, for example, the cost object might be students or a subject department, in the healthcare industry, the cost object might be a patient or medical department. Business often segregates these costs based on fixed, variable, direct, or indirect. Each company should ponder upon the various expenses they incur over the period, making the business more self-reliant and cost-efficient. When a company spends money on an advertising campaign, it debits advertising expense and credits cash. Indirect costs – those that cannot be traced to a particular object of costing.

- Examples include rent, insurance, and depreciation using the straight line method.

- Understanding period costs is essential for finance professionals seeking to make informed decisions in private equity, investment banking, and corporate finance.

- Examples of Period Costs include salaries and wages, rent, utilities, marketing expenses, and depreciation.

- For example, reducing monthly rent expenses by $1,000 would increase net income by $12,000 per year.

- While period costs are an essential component of financial analysis, it is important to differentiate them from product costs.

Accounting Ratios

These costs are expensed immediately on the income statement rather than being included in the costs of goods sold. Have you ever wondered how businesses manage their expenses beyond direct production costs? Understanding period costs is crucial for grasping the financial health of a company.

Overhead and Fixed Expenses

So they have hired a financial advisor who shall advise them on how to proceed upon the same that is getting funds and not impacting their stock price much. Discover the ins and outs of 401k account securities accounts, including pros and cons, to make informed investment decisions. While the basic service charge remains fixed, the overall utility bill can increase or decrease based on examples of period costs consumption. This involves periodically assessing the carrying value of assets for impairment and adjusting depreciation estimates as needed to reflect changes in asset values or useful lives. Branding and design expenses are for branding activities, logo design, packaging design, and brand identity development to create a consistent and memorable brand image. Looking to streamline your business financial modeling process with a prebuilt customizable template?

How Barcode Inventory Software Can Reduce Inventory Shrinkage

Period costs are sometimes broken out into additional subcategories for selling activities and administrative activities. Administrative activities are the most pure form of period costs, since they must be incurred on an ongoing basis, irrespective of the sales level of a business. Selling costs can vary somewhat with product sales levels, especially if sales commissions are a large part of this expenditure.

- Utilities such as electricity, water, heating, and internet services are essential for the smooth functioning of any office space.

- Product costs, on the other hand, are expenses that are incurred to manufacture a good and can typically be traced back to a specific product.

- These costs are essential for a business to operate, but they don’t contribute directly to the creation of long-term assets.

- Controllable costs – refer to costs that can be influenced or controlled by the manager.

- These fringe benefit costs can significantly increase the direct labor hourly wage rate.

- Product costs are allocated to the products themselves, based on the concept of cost of goods sold and inventory valuation.

These costs are relatively easy to track and assign to a specific product or project. Properly classifying costs is key for accurate financial statements, and understanding the different roles of Period and Product Costs is crucial for financial reporting. Fixed costs, on the other hand, remain the same even if production or sales levels change. For example, a company’s rent will remain the same whether they produce 100 or 1,000 units. Print advertising expenses include costs related to placing advertisements in newspapers, magazines, trade publications, and direct mail campaigns. These costs are typically expensed in the period they are incurred, rather than capitalized and depreciated over time.

Indirect Allocation

By accurately forecasting https://www.bookstime.com/ Period Costs, businesses can develop realistic budgets and allocate resources effectively. They contain both fixed and variable components, making it difficult to predict their total cost. Depreciation is considered a Period Cost because it’s incurred over time rather than directly tied to the production of goods or services. Direct Allocation is a method of assigning Period Costs directly to the specific cost object based on a clear cause-and-effect relationship. This method is straightforward and suitable for costs that can be easily traced to a single cost object. Understanding Period Costs is essential for evaluating a company’s performance and making informed decisions.