The Paradox of Trust: How DexScreener’s Scam Token Spotlight Reveals the Future of DeFi Intelligence

22 June 2025Официальный Сайт Мостбет Mostbet прохода В Личный комнату

22 June 2025Why DexScreener’s Scam Token Paradox Reveals the Secret DNA of Crypto Markets

Stop. Reread that. The platform hailed as a beacon for decentralized exchange analytics might be the very engine fueling the proliferation of scam tokens. The paradox is stark: a tool designed for transparency and empowerment simultaneously breeds opacity and risk. Yet, beneath this contradiction lies an uncharted dynamic reshaping how traders, developers, and institutions navigate the crypto labyrinth. What if the very forces that threaten the platform’s reputation are the hidden gears powering its meteoric rise and unprecedented user engagement? The answer does not lie in simple condemnation but in understanding a complex ecosystem where incentives, behavioral economics, and technological innovation collide. Prepare to unravel how DexScreener’s business model and technological architecture inadvertently mirror—and magnify—the cognitive biases and market mechanics that define crypto trading today.

The Unseen Engine: How Scam Token Promotion Drives DexScreener’s Growth

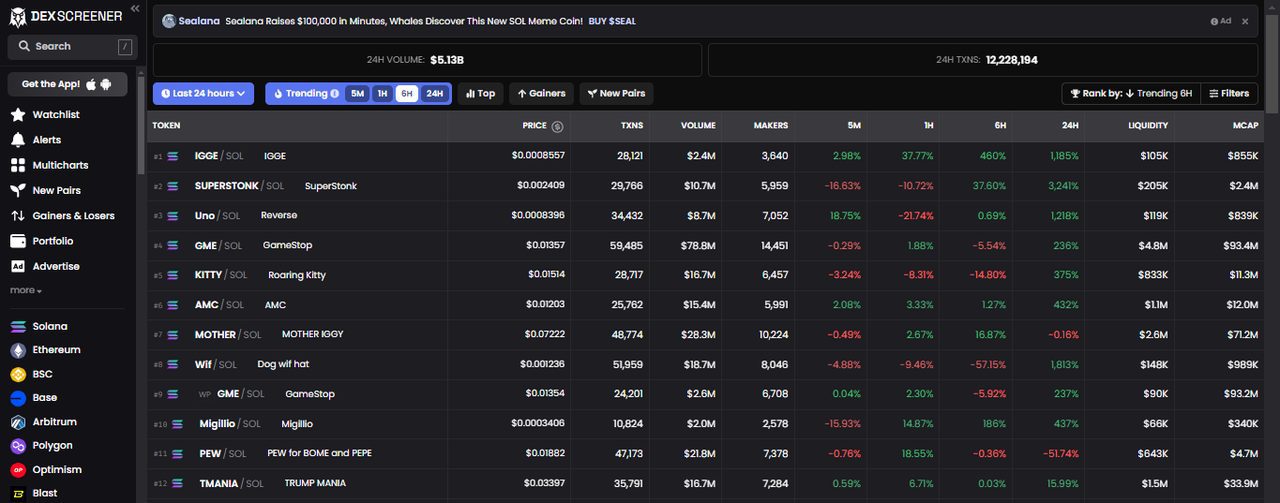

At first glance, it’s a PR disaster: DexScreener’s front page flooded with scam tokens, earning it accusations of “dark pattern” marketing and predatory practices from industry insiders like Coinbase’s Conor Grogan. Conventional wisdom demands strict censure, yet the platform’s explosive growth—12.34 million monthly visits and revenues exceeding $250 million annually—tells a different story. Why would millions flock to a site rife with questionable listings? The answer lies in the paradoxical appeal of risk and information asymmetry in crypto markets. DexScreener’s $300-per-token listing fee and premium promotional packages create a high-stakes marketplace where visibility equals survival. This pay-to-play ecosystem amplifies the “attention economy” within DeFi, turning scam tokens into ephemeral celebrities. Traders, driven by FOMO and bounded rationality, swarm these tokens, fueling volume spikes that keep the platform’s real-time analytics vibrant and indispensable. Here, the platform does not just reflect market behavior—it shapes it, creating a feedback loop that benefits both scammers and the platform’s bottom line.

Down the Rabbit Hole: How DexScreener’s Tech Moat Enables and Escalates the Paradox

DexScreener’s proprietary blockchain indexer parsing raw logs from 80+ blockchains without reliance on third-party APIs is a technological marvel. This infrastructure enables data updates every few seconds—real-time analytics on steroids—across thousands of tokens and dozens of DEXs. Integrations like TradingView’s Supercharts and wallet-free portfolio tracking democratize access to sophisticated tools once reserved for institutional traders. But here’s the twist: this tech moat, while a competitive advantage, also lowers the barrier for scam tokens to gain immediate visibility and liquidity. The platform’s algorithmic trending signals and whale tracking, designed to highlight “smart money” moves, sometimes inadvertently spotlight manipulative pump-and-dump schemes. This creates a “behavioral alpha” paradox where sophisticated analytics serve both savvy investors and opportunistic scammers alike. To grasp the full picture, one must consider how DexScreener’s microservices architecture and multi-chain data flows catalyze a market environment where cognitive biases like anchoring, loss aversion, and overtrading are weaponized—turning the platform into a battleground of human psychology and decentralized finance.

For traders eager to harness this paradox, leveraging automated price alerts, webhook integrations, and Telegram trading bots through DexScreener’s API can be a strategic edge. But beware: the same tools that alert you to early demand signals can amplify FOMO and slippage risks. This duality is the essence of modern crypto trading—where technology, behavior, and incentives form a complex web that no single player fully controls. To explore this ecosystem firsthand and enhance your trading edge, go here to access DexScreener’s powerful tools and stay ahead in the decentralized exchange analytics race.

Behavioral Economics Meets DeFi: The Nudge Design Behind DexScreener’s User Experience

Behind the sleek interface and multi-chart displays lies a subtle orchestration of cognitive nudges. DexScreener’s freemium model—free core analytics combined with paid token boosts and advertising—plays on prospect theory and the urgency effect. Users encounter a paradoxical choice overload: unlimited watchlists and alerts tempt traders to monitor countless tokens, yet the platform’s trending algorithms and highlighted “hot” tokens steer attention toward paid listings. This creates a “reputational staking” dilemma for token projects and traders alike. The platform’s design exploits loss aversion and status-seeking behavior, encouraging impulsive trades and herd mentality. It’s a digital manifestation of the prisoner’s dilemma: individual users strive to outsmart the crowd but often fall prey to collective action bias, driving volatility and impermanent loss in liquidity pools. Understanding these dynamics is crucial for traders aiming to hedge risks with slippage protection and yield-farming strategies that mitigate exposure to market manipulation and sudden token unlocks.

One can think of DexScreener as a “behavioral feedback amplifier”—a platform that not only reflects market sentiments but intensifies them through design choices, shaping trader psychology and market outcomes in real time. This insight reframes the platform not as a neutral tool but as an active ecosystem participant influencing crypto market dynamics.

From Paradox to Opportunity: Navigating DexScreener’s Complex Ecosystem

To the uninitiated, DexScreener’s reputation risks and scam token controversies might signal a platform to avoid. Yet, this very environment offers unparalleled opportunities for those who master its nuances. The platform’s expansive blockchain coverage—spanning Ethereum, Solana, BNB Chain, Polygon, and over 80 networks—combined with advanced analytics like MEV analysis, whale tracking, and volatility heatmaps, equips traders to identify early demand signals and manage FUD (fear, uncertainty, doubt). The key lies in embracing “nudge design” principles and behavioral KPIs to develop disciplined trading strategies that minimize regret and cognitive overload.

Moreover, DexScreener’s growing institutional product offerings and API services enable professional traders to integrate real-time data into algorithmic trading systems, optimizing cross-DEX arbitrage and liquidity pool allocations. The platform’s continued innovation, including its Moonshot launchpad and Boosting v2 ad packages, signals a shift toward a more sophisticated ecosystem balancing monetization with user empowerment.

Ultimately, DexScreener exemplifies the DeFi sector’s broader tension between decentralization and centralization of influence, transparency and opacity, opportunity and risk. Traders and token projects who decode this paradox stand to thrive in a market projected to grow to $616.1 billion by 2033.

Questions That Change Everything

Is DexScreener’s promotion of scam tokens an unavoidable byproduct of decentralized finance’s openness?

Yes. The platform’s direct blockchain indexing and real-time data feeds empower anyone to list tokens, reflecting DeFi’s permissionless ethos. However, this openness inherently invites bad actors. DexScreener’s challenge is balancing free access with responsible curation—a tension emblematic of DeFi’s broader governance dilemmas.

Can traders realistically use DexScreener’s tools to avoid falling victim to market manipulation?

Absolutely, but it requires a deep understanding of behavioral economics and technical signals. Features like whale tracking, token unlock alerts, and cross-chain arbitrage indicators are powerful but must be combined with disciplined risk management and an awareness of cognitive biases to be effective.

Does DexScreener’s business model incentivize ethical behavior, or does it undermine trust in decentralized analytics?

The freemium model’s reliance on paid token listings creates conflicting incentives—monetary gain can overshadow platform integrity. While this boosts revenues and innovation, it also raises reputational risks and regulatory scrutiny. The company’s future success hinges on evolving governance policies that align monetization with user trust and market health.