Why the Most Trusted Crypto Analytics Platform Is Also Its Own Greatest Threat—and What That Means for Your Trades

22 June 2025Why DexScreener’s Scam Token Paradox Reveals the Secret DNA of Crypto Markets

22 June 2025Why The Most Trusted Crypto Analytics Platform Is Also Its Own Biggest Paradox

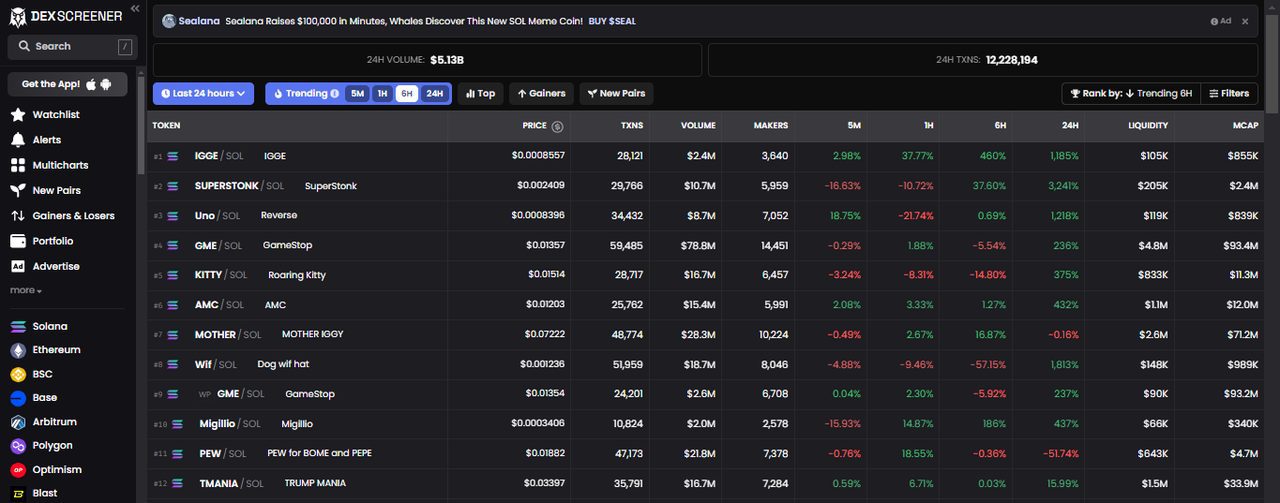

Imagine a tool that millions of crypto traders rely on daily to navigate the wild seas of decentralized exchanges — yet that very tool is accused of fueling the storm it promises to help you avoid. DEX Screener, a titan in blockchain analytics, commands over 12 million monthly visits, boasting unparalleled real-time data from 80+ blockchains and a sleek interface powered by TradingView charts. But beneath this technological marvel lies a paradox: its soaring revenues depend heavily on promoting tokens that many experts label as scams. How can a platform be both a beacon of transparency and a harbor for shady projects? More importantly, what does this reveal about the fragile psychology of crypto traders and the hidden incentives shaping the DeFi ecosystem?

The Illusion of Neutrality: When Free Access Becomes Paid Persuasion

At first glance, DEX Screener feels like the purest form of decentralized analytics—a free, permissionless window into over 100 DEXs and 5,000+ tokens. The proprietary blockchain indexer bypasses external APIs, offering direct on-chain data with second-by-second updates. The interface is intuitive, the TradingView charts are sophisticated, and the user base is massive and growing. Yet, this transparency is a double-edged sword. The platform’s business model hinges on paid token listings and promotional boosts starting at $300, with premium campaigns exceeding $100,000. This “freemium paradox” cloaks a subtle nudge design: tokens willing to pay get front-page visibility, tapping into FOMO and anchoring biases of traders who assume “featured” means “legit.” Suddenly, neutrality is compromised not by data manipulation but by economic incentives that weaponize user attention.

This tension exposes a rarely examined behavioral fault line in crypto markets—the “attention economy” within DeFi analytics. Traders’ bounded rationality makes them vulnerable to “dark patterns” where paid prominence masquerades as meritocratic discovery. The platform’s disclaimers do little to counteract the subconscious trust heuristics triggered by placement and highlighting. What seems like open data becomes a curated signal amid noise, a channel where perception often trumps reality.

Decoding the “Promotional Feedback Loop”: How Scam Tokens Thrive on Analytics

Here lies the rabbit hole: DEX Screener’s rapid rise is entwined with the meteoric growth of meme coins and speculative tokens, many of which lack genuine fundamentals. The platform’s Moonshot launchpad alone helped spawn over 7,000 meme coins on Solana within months, leveraging audited contracts and liquidity unlocking—a technical moat that ironically accelerates unvetted projects to market. This creates what I call the “Promotional Feedback Loop,” where analytics platforms drive demand by boosting visibility, which in turn inflates trading volume and perceived liquidity, attracting more users and revenues.

Yet, this loop is fragile. The platform faces persistent criticism—from Coinbase’s product head to Crypto.news—for enabling scam token propaganda and market manipulation. Despite no public lawsuits, the reputational risk is high. Traders caught in this cycle suffer loss aversion and liquidation anxiety, often overtrading based on social proof and whale tracking signals amplified by the platform itself. The paradox is stark: the very infrastructure designed to demystify DeFi liquidity dynamics simultaneously fuels volatility and FUD (fear, uncertainty, doubt).

To navigate this, savvy traders must develop what I term “behavioral alpha”—a mental model combining on-chain analytics with cognitive coaching to recognize nudges and emotional biases embedded in the platform’s design. This is where tools like automated price alerts, Telegram trading bots, and customized webhooks become indispensable, helping users step back from Pavlovian trades triggered by platform-driven signals.

Beyond Data: The Invisible Tug-of-War Between User Trust and Monetization

DEX Screener’s astonishing operational efficiency—a tiny remote team managing a platform with $250 million+ annual revenues—rests on highly automated, scalable blockchain indexing technology. Yet, this lean model magnifies vulnerabilities: with only 8-10 employees, the ability to moderate listings is limited, making the platform susceptible to “dark patterns” favoring paid token promotion. The result is a reputational paradox where user trust is both the platform’s greatest asset and its most fragile liability.

Regulatory shadows loom large. While DEX Screener currently faces no enforcement actions, growing scrutiny over DeFi advertising ethics could force a radical shift in business models. The platform’s refusal to issue its own token and reliance on listing fees expose a dependency on the very ecosystem it must police. This creates a strategic dilemma akin to a prisoner’s dilemma: strict moderation reduces revenue but builds trust; lax controls maximize short-term profits but risk long-term viability.

For traders, this underscores the importance of multi-source verification and skepticism. Leveraging cross-DEX arbitrage, slippage protection, and yield-farming strategies in parallel with analytics reduces exposure to platform-induced FOMO and loss aversion. Moreover, recognizing how cognitive overload and information asymmetry are exploited can transform trading from reactive impulse to disciplined strategy.

The Future of DEX Analytics: Personalization, Trust, and Behavioral UX

Looking ahead, the evolution of platforms like DEX Screener lies at the intersection of technology and behavioral design. Innovations such as personalized dashboards, dynamic pool fees, MEV analysis, and social sentiment integration promise to deepen user engagement. However, these advances must be balanced with transparency cues, nudge design principles, and trust heuristics that mitigate overtrading and regret minimization.

Imagine a tool that not only surfaces on-chain whale movements and volatility heatmaps but also actively coaches users through disposition effects and anchoring biases, integrating behavioral KPIs and urgency effects into alerts. This “behavioral UX” could transform analytics from a passive data feed into an interactive mentor, addressing the cognitive challenges of decentralized finance.

To experience how such a platform can optimize your trading workflow and help you sidestep common psychological traps, you can go here to download the latest version of DEX Screener’s mobile app. Combining powerful analytics with growing personalization features, it exemplifies the next frontier where data meets decision psychology.

Questions That Change Everything

Is it possible that the platform I trust most is the one amplifying my trading mistakes?

Yes. Platforms like DEX Screener leverage attention economy incentives, making paid promotions appear as trustworthy signals. Without awareness of these “dark patterns,” traders risk falling into feedback loops of overtrading and FOMO. Developing behavioral alpha and using complementary tools can break this cycle.

Can decentralized analytics truly remain neutral when monetization depends on token advertising?

Complete neutrality is challenging. The economic model creates inherent conflicts of interest. Transparency about promotional practices and user education on cognitive biases are essential to maintain credibility and user trust.

How should I adapt my trading strategy given the paradoxes in DeFi analytics platforms?

Adopt a multi-layered approach: combine real-time on-chain data with behavioral coaching techniques, set automated alerts to reduce emotional trading, and diversify across DEXs to avoid platform-specific bias. Recognize that no platform is infallible—your edge lies in disciplined interpretation.